|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Pet Insurance for Cats Reviews: Comprehensive Guide to Choosing the Right PolicyWhy Consider Pet Insurance for Your Cat?Pet insurance is becoming an essential consideration for cat owners. Veterinary bills can be unexpectedly high, and a good insurance plan can provide peace of mind. Here, we delve into the importance of pet insurance and how it can save you money in the long run.

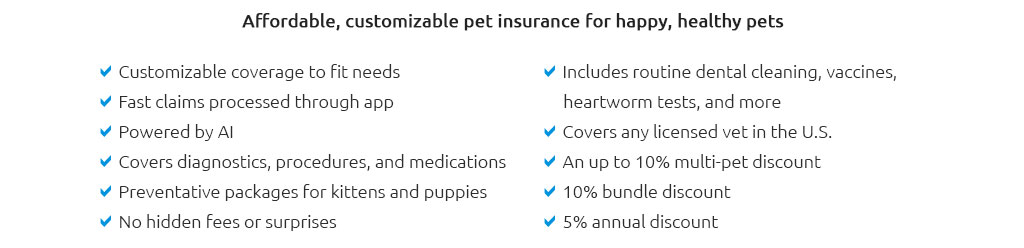

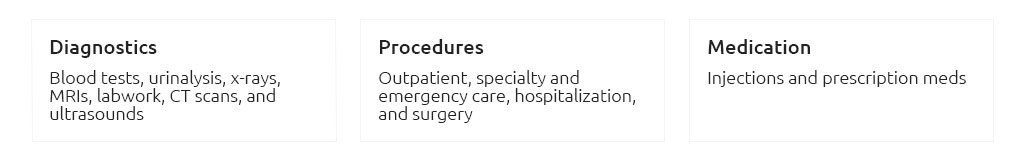

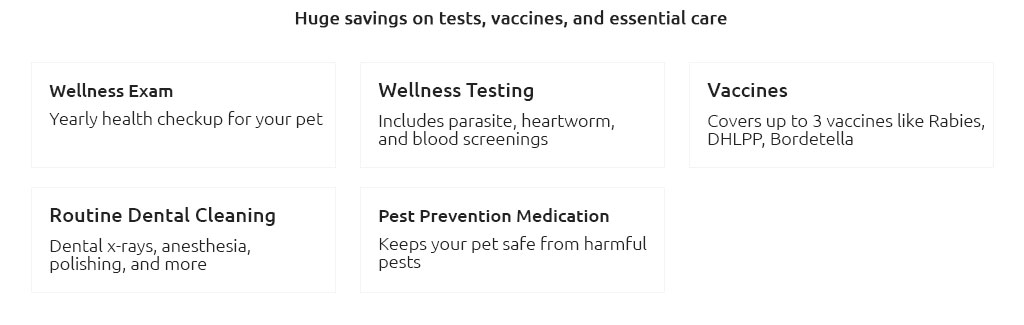

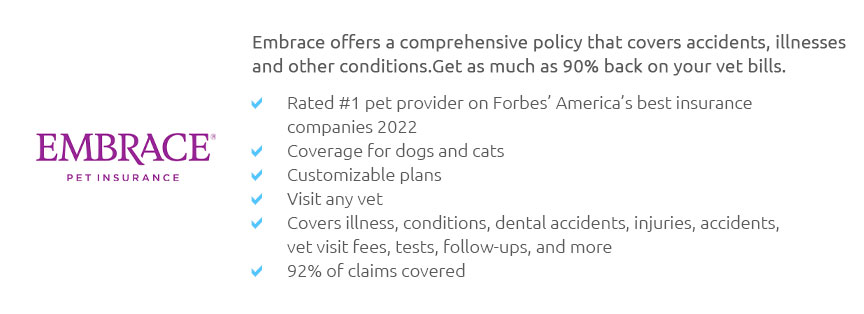

Key Features to Look for in Cat InsuranceCoverage OptionsWhen selecting a pet insurance policy, look for coverage options that suit your needs. Some plans cover only accidents, while others include illnesses, hereditary conditions, and wellness care. It's crucial to understand what is included to ensure comprehensive protection. Reimbursement LevelThe reimbursement level determines how much of the veterinary bill will be covered. Common levels are 70%, 80%, or 90%. Choose a level that balances your budget with your desired level of protection. DeductiblesDeductibles can be annual or per incident. A higher deductible usually means a lower premium, but ensure it's an amount you can afford to pay if needed. Top-Rated Pet Insurance CompaniesBased on customer reviews and expert analysis, the following companies are highly rated for their cat insurance policies:

For a deeper understanding of how family-oriented plans can be beneficial, explore the pet insurance family plan option, which might offer additional perks for multi-pet households. Considering Special ConditionsSome cats have special conditions such as FIV (Feline Immunodeficiency Virus). It's crucial to choose an insurance that accommodates these needs without exorbitant costs. For more on this, visit the pet insurance fiv positive cats guide. Frequently Asked Questions

ConclusionChoosing the right pet insurance for your cat involves understanding the coverage, costs, and benefits. By carefully reviewing available plans and considering your cat's unique needs, you can ensure that your feline friend receives the best possible care without financial strain. Pet insurance is an investment in your cat's health and your peace of mind. https://www.quora.com/What-is-your-opinion-on-pet-insurance-for-cats-Have-you-ever-bought-it-before-If-so-what-was-your-experience-and-would-you-recommend-it-to-others

We have had pet insurance for our cats for at least 15 years. It was the best investment we ever made when it comes to taking care of our ... https://www.nytimes.com/wirecutter/reviews/best-pet-insurance/

However, in 2017, our fictitious cat cost an average of $52 per month to insure. In 2021, establishing coverage for a new pet cost $143 a month ... https://cats.com/best-pet-insurance-for-cats

On PetInsuranceReview.com, customers give it a 4.9/5 rating with 672 reviews. Customers are satisfied with the pricing, customer service, and ...

|